Custom Private Equity Asset Managers for Dummies

Wiki Article

The Buzz on Custom Private Equity Asset Managers

You've most likely listened to of the term personal equity (PE): purchasing firms that are not publicly traded. Approximately $11. 7 trillion in properties were taken care of by personal markets in 2022. PE companies seek chances to gain returns that are far better than what can be accomplished in public equity markets. There may be a couple of things you don't recognize about the market.

Exclusive equity companies have an array of financial investment preferences.

Since the very best gravitate towards the larger bargains, the center market is a considerably underserved market. There are a lot more sellers than there are highly skilled and well-positioned finance professionals with comprehensive buyer networks and resources to take care of an offer. The returns of personal equity are normally seen after a few years.

Getting My Custom Private Equity Asset Managers To Work

Flying below the radar of large international corporations, most of these small firms typically offer higher-quality customer care and/or niche services and products that are not being provided by the large empires (https://www.slideshare.net/madgestiger79601). Such advantages bring in the interest of personal equity companies, as they possess the understandings and wise to manipulate such chances and take the company to the next degree

Many supervisors at portfolio firms are offered equity and reward settlement structures that reward them for striking their financial targets. Personal equity possibilities are typically out of reach for individuals that can't invest millions of bucks, yet they shouldn't be.

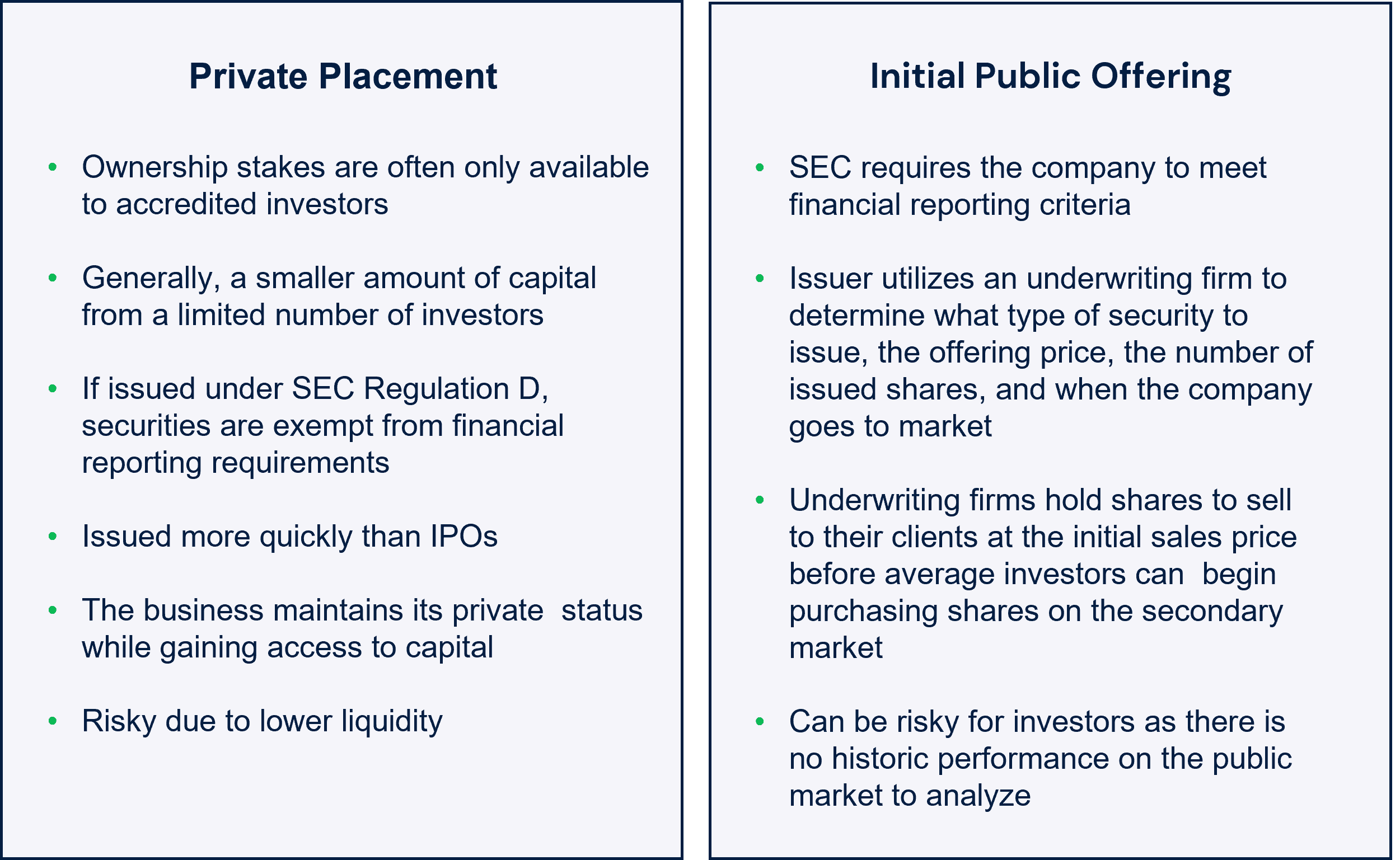

There are laws, such as limits on the aggregate quantity of money and on the number of non-accredited financiers (Private Investment Opportunities).

All about Custom Private Equity Asset Managers

An additional negative aspect is the absence of liquidity; as soon as in a private equity purchase, it is difficult to get out of or sell. There is an absence of adaptability. Private equity additionally includes high costs. With funds under administration currently in the trillions, exclusive equity firms have come to be appealing investment vehicles for affluent individuals and establishments.

For years, the attributes of exclusive equity have made the property course an eye-catching recommendation for those who could take part. Since accessibility to personal equity is opening approximately even more individual financiers, the untapped capacity is coming true. The question to consider is: why should you invest? We'll start with the major debates for purchasing private equity: How and why personal equity returns have historically been higher than other possessions on a variety of degrees, Exactly how consisting of exclusive equity in a portfolio affects the risk-return profile, by assisting to expand versus market and intermittent danger, After that, we will certainly detail some crucial factors to consider and threats for exclusive equity investors.

When it concerns presenting a brand-new possession right into a profile, the most basic factor to consider is the risk-return account of that asset. Historically, exclusive equity has exhibited returns comparable to that of Emerging Market Equities and greater than all other standard asset courses. Its fairly low volatility paired with its high returns produces a compelling risk-return account.

10 Simple Techniques For Custom Private Equity Asset Managers

In truth, personal equity fund quartiles have the best array of returns across all alternative possession courses - as you can see below. Approach: Inner price of return (IRR) spreads out determined for funds within classic years separately and after that balanced out. Average IRR was determined bytaking the standard of the median IRR for funds within each vintage year.

The takeaway is that fund selection is crucial. At Moonfare, we perform a rigorous choice and due diligence procedure for all funds listed on the system. The effect of adding exclusive equity into a portfolio is - as always - based on the portfolio itself. A Pantheon study from 2015 suggested that including private equity in a profile of pure public equity can open 3.

On the various other hand, the best exclusive equity companies have access to an even bigger pool of unidentified chances that do not face the same scrutiny, in addition to the resources to carry out due diligence on them and determine which deserve buying (TX Trusted Private Equity Company). Investing at the first stage implies higher risk, however, for the firms that do prosper, the fund gain from greater returns

The Ultimate Guide To Custom Private Equity Asset Managers

Both public and private equity fund managers commit to investing a percent of the fund but there remains a well-trodden issue with straightening rate of interests for public equity fund administration: the 'principal-agent issue'. When an investor (the 'major') hires a public fund manager to take control of their resources (as an 'representative') they hand over control to the supervisor while maintaining possession of the possessions.

In the case of personal equity, the General Partner does not simply earn a monitoring charge. Private equity funds additionally mitigate another type of principal-agent problem.

visite siteA public equity capitalist ultimately wants one point - for the management to boost the stock cost and/or pay rewards. The capitalist has little to no control over the decision. We showed over exactly how many exclusive equity methods - particularly majority acquistions - take control of the running of the business, making sure that the lasting value of the business precedes, raising the return on investment over the life of the fund.

Report this wiki page